“Never doubt that a small group of thoughtful committed citizens can change the world: indeed, it’s the only thing that ever has.”

– Margaret Mead

Current Trends, Updates on Privacy for Nonprofits, and new IRA Tax Law!

Welcome back, readers and nonprofit marketers, to our quarterly newsletter. We closed out 2022 gathering with our industry friends and colleagues to recap the year and celebrate high level accomplishments at events such as the DMAW Best of Direct Awards and DMFA Marketer of the Year and Holiday Luncheon. Heading into Q1 2023, we are gearing up for the new TNPA Symposium in March. There has been much movement in our space in terms of acquisitions and mergers, and more push to digital engagement.

Highlights to follow in this quarter’s issue include an update on privacy in the nonprofit sector, overall results trends through December 2022, some exciting changes to the laws around donating to nonprofits through an IRA, as well as key insights from the Winterberry Group.

Please be sure to save our overview of upcoming events as we continue to catch up in person with each of you. As always, if there is an issue you want to learn more about, let us know! We love to hear from those of you who are at the source of nonprofit marketing. Please feel free to send us questions and topics that you would like to see covered or included in any of our future surveys at nonprofit@adstradata.com. You can also learn more about us at adstranonprofit.com, and again please pass this newsletter along to a colleague so they too can sign up and join in the discussion.

–Your Adstra Nonprofit Leadership Team

Trend Report

Privacy Update

2023 marks a pivotal moment in the relationship between advertising and consumer privacy. After significant debate and consideration, five state-wide laws went into effect on January 1, but potential for enforcement for many of those laws begin in July.

The delayed enforcement creates a cascade of events that will shape the new year. First and foremost, it will likely push U.S. Congress to pass federal legislation that pre-empts this patchwork of state laws. Second, it requires that advertisers get serious about addressing ongoing privacy concerns and learning from the errors of the past.

Nonprofits have an increasingly complex role with these privacy laws, although only Colorado’s applies to the sector currently. All the other state laws exempt nonprofits, however despite this reality, there is still an impact on the sector. The burdens placed on corporate providers of data to nonprofits have stopped many small to mid-sized data providers from doing business in California, creating obstacles and extra expense for nonprofits communicating with supporters in California and soon-to-be other states enacting similar laws.

With regard to Colorado SB 190, the Protect Personal Data Privacy Act, was signed into law on July 7, 2021, and will take effect on July 1, 2023. Major provisions include:

- Enable a consumer to opt-out of the processing of their personal information

- Confirm whether or not a controller is processing personal data concerning the consumer and to provide access to that information

- The right to correct inaccurate personal information

- The right to have personal information deleted

- Controllers would be required to provide a meaningful privacy notice to consumers detailing their various rights

- Does not contain a private right of action

The current landscape for nonprofits is nowhere near as difficult as it is for profit organizations, but it will be important to pay very close attention as more states enact privacy laws.

Research Corner

Key Findings from Winterberry Group’s Annual Research

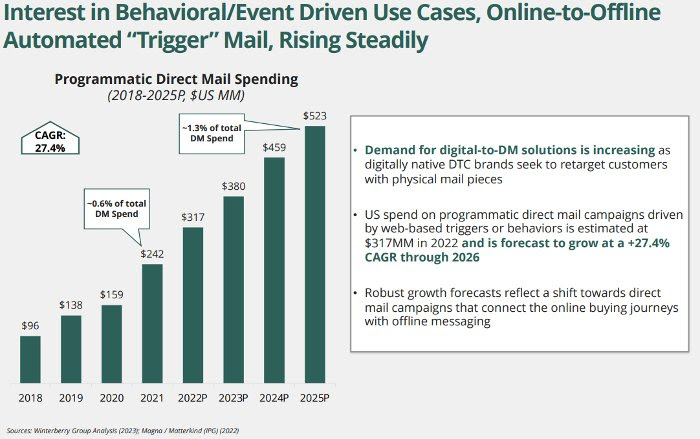

Winterberry is seeing potential for online investment to decelerate, while direct mail is expected to grow in 2023. In addition, investment in CTV will continue to rise.

Key growth drivers expected to impact 2023 include:

- An increased emphasis on customer experience to drive retention, tightening marketing spend management

- Direct Mail making a comeback

- The convergence of Linear & CTV speeds along, though not seamlessly

- The loss of identifiers, privacy regulation and the race for first party data relationships

- Agencies are expected to see above market spend at 8.5 percent

“The rising cost of digital media and shifting consumption patterns is encouraging marketers to shift spend not just amongst channels, but among providers who have the ability to target hard to reach niche audiences” said Biegel.“We expect the growth rate of digital channels to decelerate but remain strong. Offline bright spots for marketers include experiential marketing as events return and direct mail, as a predictable performance media channel.”

To download the full presentation, click here

Expansion of the IRA Charitable Rollover

Nonprofits have long since been benefiting from donors over the age 70 ½ who make direct distributions from their individual retirement account (IRA) to public charities. Widely known as an IRA charitable rollover or a qualified charitable distribution, this action allows the donor to not count these distributions

as a withdrawal from their IRA and thereby not classified as income for tax purposes. On December 29th, 2022, the President signed the Fiscal Year 2022 Omnibus Appropriations Bill.This legislation included several enhancements designed to encourage charitable giving by allowing seniors to make tax-free contributions from their IRAs to charities through life-income plans. Starting in 2023, donors can use their IRAs to fund a charitable gift annuity or charitable remainder trust. Additionally, the annual distribution cap of $100,000 will be indexed to inflation and increased to ensure nonprofits continue to see the same value of these gifts year over year.

Specific Provisions

- A donor can make a one-time gift election to fund a life-income-gift with an IRA and must be done in one tax year only

- The aggregate limit of the IRA funded life-income gifts is $50,000

- The direct distribution from the donor’s IRA to a life-income plan counts toward their required minimum distribution for that year

These tax benefits can help seniors create an income stream during their lifetimes while making gifts to organizations they are passionate about when they are gone.

The next step is spreading the word and ensuring donors understand and take advantage of these tax changes.

Nonprofit Fundraisers Symposium

March 15-17, 2023 │Hilton National Mall at the Wharf, Washington DC

Click here to learn more and sign up

DMFA Donor Advised Fund Insights

March 15, 2023│11:45a – 2:00p │ Club 101, 101 Park Ave, NYC

This session will highlight the donor experiences that really shined, flag problem areas, and share ideas you can use to enhance DAF giving and donor experiences.

Click here to learn more and register

DMAW – DM 101

March 23, 2023 │ 8:30a – 4:15p│ SEIU, 1800 Massachusetts Ave. NW Washington, DC

Our very own Tom Fleming will be speaking!

The ever-popular DM101 is returning with sessions including: Creative Strategy, List Strategy for Aquisition, Data Hygiene/Data Processing, Production Services, Database/Analytics, Online Marketing, Multi-Chanel and Telefundraising/Text Marketing followed by a Wrap Up and Q&A Session.

Click here to learn more and register

DMFA – DM 101

April 20, 2023 │Jay Suites Times Square│1441 Broadway at Seventh Avenue, New York, NY

Our very own Tom Fleming will be speaking!

Come hear from other young professionals to discuss professional development and other important career topics in a friendly round table luncheon. Click here to learn more and register

DMFA Happy Hour

May 2, 2023 │5:30p – 7:30p │ 1205 11th Street NW

Suite 450, Washington, DC

Join the DMFA in Washington DC at Supra for an evening of networking. Mingle with your industry friends and make new ones over drinks and light appetizers.

Click here to learn more and register

List Bazaar

May 11, 2023 │8:00a – 4:00p │ The National Union Building

918 F Street NW 4th Floor

Washington, DC

For nearly 40 years, List Bazaar has been the industry’s only show created by list professionals for list professionals.

List Bazaar is where list brokers and managers come together to hear about the latest trends and discuss the most urgent issues surrounding our unique and critical corner of the industry.

Click here to learn more and register